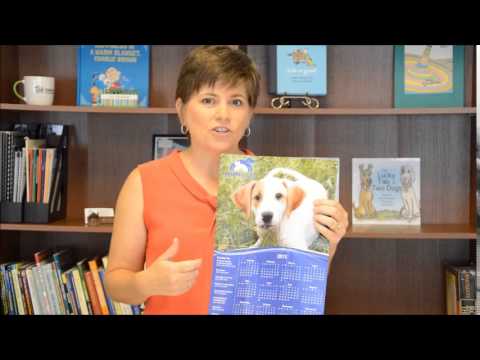

Hey, you just wrapped up your fiscal year, congratulations and Happy New Year! I used to love this time of year because it meant a fresh slate. It meant like a blank piece of paper that I could dream up new things and implement new kinds of fundraising strategies and go raise some big money. If this is you, you're not done yet. You've got to go back and report to all the people who gave to you and let them know what you were able to accomplish. In other words, you need to do an annual report. Now, an annual report does not have to be real complicated. It doesn't have to be expensive or fancy. But it does need to contain some key pieces of information to help your donors feel really good about their decision to give to you. Now earlier this year, I saw one that I wanted to share with you. This is an annual report from the Humane Society of Greater Dayton in Dayton, Ohio. What I love about this is it's very simple. As you can see, it's a trifold brochure. This means that they had to be very concise about the information that they wanted to share. They couldn't put all kinds of fluffy stuff in there or things that didn't matter. What they did include were some key pieces of results for the year, a brief history, even some financial information. And when you open this thing up, check it out, there's a calendar inside. How cool is that? As a donor, I could hang that in my kitchen or in my office and I'm reminded throughout the year of the organization that I love. I love that, like that great picture. I love that one. Here's another thing I really like about this...

Award-winning PDF software

Report nonprofit misconduct Form: What You Should Know

If the complaint is about noncompliance with state laws or regulations, the complaint should include the facts (i.e., what you claim is the basis of the complaint) and a brief statement concerning the law or regulations alleged to be unfair or arbitrary. You must complete Form 13909 with one original and one copy to maintain the tax-exempt status of your charity. See also IRS Publication 956, State Tax Agency Contact Information and State Regulatory Authorities (Regulatory Reporting) for the IRS. You may include a brief explanation of your complaint about IRS's enforcement action (e.g., “Revenue Service is using Form 990 (which was submitted by the charity, but does not have Form 13909 on file), which does not reflect the charity's tax-exempt status”). If you are unable to submit a form or the original copy is lost or destroyed, a copy must be provided to the IRS at its address or within 10 days. Any complaints submitted on or after July 29, 2016, are forwarded to the State Tax Agency (STA) or State regulatory agency. The State Tax Agency's website at: provides general information such as forms to file complaints. If you have additional questions about their hotline or address inquiries, please contact us at: or (toll-free). WHAT TO BRING TO THE CONSUMER SERVICE CENTER You can contact the consumer service center by calling (toll-free) or you may fax the complaint to the Consumer Contact Center at:. Or, you can submit in paper form: A completed form with the following information: The name of the charity; The tax-exempt status and number of the agency; A brief statement concerning the law or regulations alleged to be unwarranted; and A copy of the organization's Internal Revenue Service Form 990. There also may be additional fees to file a complaint. Contact the appropriate SSA or other regulatory agency.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 13909, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 13909 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 13909 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 13909 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Report nonprofit misconduct