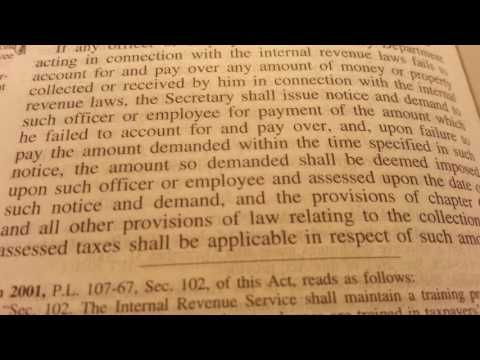

Okay, the purpose of this video is to discuss delinquent Internal Revenue officers who take a long time to do your taxes or employ delay tactics, such as address changes or verification paperwork. This is despite the fact that you signed the return under penalty of perjury. These officers then go ahead and take pictures of the return. This video aims to provide information on how to deal with delinquent and troublesome revenue officers and employees. According to the Internal Revenue laws, any officer or employee of the Treasury Department who is involved in this process is considered a government employee. If you work for a corporation, you are also considered a de facto government employee and must file your taxes accordingly. If you file them incorrectly, you may receive a locked-in letter, and your wage deductions will be approximately twenty-seven percent. If the officers take too long to return your property, you can complain to the secretary by using the Section 1203 allegation referral form. This form may be a bit misleading, so make sure to search for the correct form. The form is used to report any misconduct or delays by revenue officers or employees. When completing the form, check the "other" option since you are not a government employee. In the summary of the allegation section, include the information provided in the video about delinquent officers. If necessary, summarize it in your own words. Include Section 78045(c) in the form and send it to the tax inspector general. You can find his address on the form itself to avoid waiting on hold for a long time. It seems like he may be busy playing golf.

Award-winning PDF software

Internal revenue service complaint Form: What You Should Know

Requesting a Claim for Underpayment — IRS Sep 16, 2025 — The Department of Labor is authorized to process Wage and Hour-related complaints, including a claim for underpayments, under the provisions of the Fair Labor Standards Act (FLEA) as amended; and other complaints involving violations of the laws relating to minimum wage, overtime, minimum wage statutory interpretations, and child labor. Requesting to Report an Employer's Failure to Pay the Minimum Wage Due — IRS Please complete and send a Form 2555, Claim for Refund of Underpayments and Under-Maximum Wage (Form 2555-B). Requesting to Report Wage Payments in Dispute — IRS Please follow this link and complete and submit a Form 1095, Return of Overpayment to Payroll Expense Tax with IRS for Wage Payments. Please use the same address for all requests. Requesting the Department of Labor to Determinations and Enforcement — IDOL — Illinois.gov The Department of Labor's Wage and Hour division does not provide wage disputes. Report a Lobbying Violation — IRS The Department of the Attorney General does not enforce the Illinois lobbying laws, or provide enforcement services for non-lobbying regulatory matters. Report a Violation of the Consumer Purchases and Use Tax Act (SPUTA) — IRS The Department of Revenue does not provide information to the Public on any purchase or use tax violation. You may check whether the department has investigated a complaint. Submit an Online Complaint Form — IDOL — Illinois.gov. The Department of the Attorney General offers forms for online requests of government agency administrative agencies. Please complete your complaint and submit your complaint information in PDF format to the designated location on their website: . For a list of agency-specific forms available on their website click here. Request for a Tax Refund Form — IRS The Department of Revenue does not issue refunds to non-residents of Illinois. Report Fraud, Waste, Unauthorized Financial Transactions, and Other Problems Report Fraud, Waste, Unauthorized Financial Transactions, and Other Problems Report a Crime or Fraud/ Misconduct — IRS The Department of Justice's Office of the Inspector General or local law enforcement agencies are authorized to accept tax-related complaints. Request a Form — IDOL — Illinois.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 13909, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 13909 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 13909 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 13909 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Internal Revenue Service Complaint Form