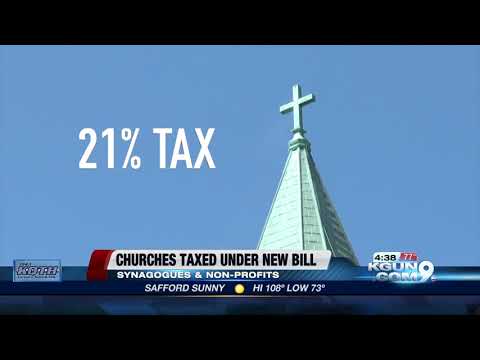

Churches, synagogues, and nonprofits are discovering that they may have to pay taxes for the first time. - This new tax law is related to the tax overhaul that occurred this year, and it has left many people confused. - The tax law, part of the Republicans' tax cut and Jobs Act, has caught churches and nonprofits off guard. - According to this law, churches, synagogues, and nonprofits would now have to pay taxes on transportation perks provided to their employees, such as parking or commuting benefits like bus or subway passes. - Interestingly, even church parking lots can be subject to taxation if the pastor uses the parking space for office hours. - This aspect of the new tax law seems nonsensical to Politico, as it poses a burden on churches that provide such services. - Politico reports that this 21% tax could result in tens of thousands of dollars being paid annually by some churches. - Unfortunately, this tax will decrease the budgets allocated to community services, making it difficult for churches to offer as much as before. - Recently, around 900 organizations have signed a petition asking Congress to eliminate this tax. - The National Council of Nonprofits, labeling the tax changes as a train wreck, highlights the confusion surrounding its implementation. - Meanwhile, a Republican lawmaker has introduced legislation in Washington DC to repeal the tax. - This is Cory Rangel reporting for the historic hearse.

Award-winning PDF software

Reporting a nonprofit for illegal activity Form: What You Should Know

It is therefore imperative that you report anything you know to the appropriate IRS office. There are two main complaints, though. The first is the following: 1. A charitable organization has spent more than its own budget or is over-funded with private donations that could have been used in its program. A complaint may be received by: The charitable organization's IRS Form 990, including information on the charity's annual financial statement. If you are not able to find this on the 990, contact the Foundation Relations Office of the non-profit, or contact the non-profit in your state. If you are unable to contact the non-profit in your state, contact your state Attorney General's office. The Foundation Relations Office of the non-profit, or contact the non-profit in your state. If you are unable to contact the non-profit in your state, contact your state Attorney General's office. For more information see IRS Publication 514 (Non-Profit Organizations). The second complaint is the following: 2. Any solicitation from a charitable organization includes any communication that is sent or circulated to solicit funds as charitable contributions from any individual, corporation, or unincorporated organization. A complaint may be received by: The IRS. The non-profit (its attorney, its accountant, the non-profit's secretary, or someone else at its organization.) The non-profit's public communication, which may be published in a published newsletter if the charity has one. The non-profit will usually receive a complaint letter, which has a legal significance as written communication between the non-profit and a member of the public is defined as an “incident” and not an “official transaction.” The Nonprofit is then free to make its case to the IRS. Some charities prefer to resolve a complaint within the legal process before the IRS gets involved. For more information about a complaint, see the How Do I File a Complaint? Page. How do I file a complaint against a tax-exempt organization? The IRS will only get involved if it has received a complaint that demonstrates that a charitable organization has: Made false or fraudulent statements or representations; Intended to defraud or mislead anyone; Been issued an incorrect or misleading tax identification number (e.g.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 13909, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 13909 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 13909 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 13909 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Reporting a nonprofit for illegal activity