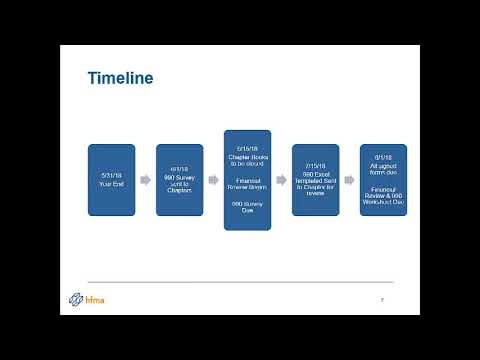

Thank you for your participation in today's webinar. Today's session will count towards your chapter's DCMS education hours for 2018-2019, and chapters will receive one hour DCMS education credit for each attendee. At the end of the presentation, please take a few moments to complete the online evaluation. Your feedback is very important to us as it is used to enhance future chapter leader webinars. Now, I would like to turn the presentation over to Joyce Themout, the Senior Vice President and Chief Financial Officer of HMA. Joyce will be discussing the process of accumulating chapter information and preparing the 990s on behalf of your chapters. It is important to note that all chapters are incorporated in the state of Illinois, and HMA is responsible for filing the federal tax returns on their behalf in a group return. Today, we have several participants from our HMA finance team joining us. In addition to Joyce, we have Carla BIagoes, who has been with HMA since October of last year, Bonnie Nolan, who has been with HMA for about two years, and Steve Delabar, the Accounting Manager. They will be providing support and assistance throughout the process. Now, let's move on to the main topic of today's presentation, which is chapter finance information.

Award-winning PDF software

How to report a nonprofit organization to the irs Form: What You Should Know

Find information on annual reporting and filing using Form 990 returns, and applying and maintaining tax-exempt status. May 31, 2024, IRS Office of Chief Counsel Jun 12, 2022 IRS Offices in Kansas City, Missouri May 29, 2024, IRS Offices in Kansas City, Missouri — Find FAQs on filing 990 990-EZ, Income Tax returns, and Form 990-NR for individuals, and Form 990-PF for businesses. IRS Offices in Kansas City, Missouri — Find FAQs on filing 990 990-EZ, and Forms 990-T and 990-PF for individuals, and Forms 990-NR for businesses. Jun 12, 2026 IRS Offices in Kansas City, Missouri IRS Offices in Little Rock, Arkansas IRS Offices in Las Vegas, Nevada IRS Offices in Little Rock, Arkansas, and St. Louis, Missouri IRS Offices in Louisville, Kentucky IRS Offices in Little Rock, Arkansas, and St. Louis, Missouri IRS Offices in Louisville, Kentucky and Tulsa, Oklahoma IRS Offices in Little Rock, Arkansas, and Tulsa, Oklahoma IRS Offices in Little Rock, Arkansas, and Tulsa, Oklahoma Jul 14, 2029 IRS Offices in Kansas City, Missouri IRS Offices in Little Rock, Arkansas, and Tulsa, Oklahoma IRS Offices in Little Rock, Arkansas, and Tulsa, Oklahoma IRS Offices in Little Rock, Arkansas, and Tulsa, Oklahoma Aug 01, 2029 IRS Office of Chief Counsel Find information on filing Form 4902 and 4910 and Form 4919, Miscellaneous return report, and Forms 4911, Miscellaneous tax return file and report and the instructions.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 13909, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 13909 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 13909 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 13909 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to report a nonprofit organization to the irs